- Home

- Craft Pricing

- Handmade Business Expenses

Craft Pricing: How to Track Expenses and Price Handmade Products for Profit

Craft pricing starts with knowing your numbers, and that means understanding every expense involved in running your handmade business.

Do you know exactly how much it costs to make your products?

Whether you use a formal pricing formula or a more intuitive method, It's essential to have a solid grasp of your business expenses in order to set profitable prices.

Tracking your costs doesn't just help you set the right price, it gives you more control over your finances.

You'll be able to:

- identify when your business becomes profitable

- understand where your money is going

- spot opportunities to reduce costs

- focus on the products and sales strategies that deliver the best return

Carefully recording your expenses also ensures you're maximizing any tax deductions allowed in your area - an important benefit for every small business owner.

Note: This information is meant to be used to help you price your crafts. There is overlap with business accounting; however, I am not an accountant. If you're looking for help with accounting, you should contact a professional accountant.

How to Track Handmade Business Expenses

Table of Contents

Why Tracking Expenses Is Crucial for Craft Pricing

Types of Craft Business Expenses

- Materials Cost

- Labor Costs

- Overhead Expenses

- List of Common Overhead Expenses

How to Use This Information to Price Your Crafts

Tools: Printable Expense Checklist & Online Pricing Calculators

Why Tracking Expenses Is Crucial for Craft Pricing

Before you can start pricing handmade crafts for profit, you need a clear picture of what it costs to run your craft business.

That's where expense tracking comes in.

If you understand the total cost of creating and selling your work, you'll be prepared to price products profitably. If you overlook hidden or indirect costs, your margins will be slim at best.

By tracking all of your expenses, you gain insight into:

- Profitability: Know exactly when you're making a profit (and when you're not)

- Spending patterns: Spot where your money is going and where you may be overspending

- Opportunities to save: Identify unnecessary or inflated expenses

- Product performance: Understand which products and sales channels deliver the best return

Without this knowledge, pricing handmade goods is just guesswork, and guesswork can cost you money. When you build your pricing around real data, you can confidently set prices that support your income goals while remaining fair and competitive.

Recording your costs also plays a vital role in tax preparation. Keeping thorough and accurate financial records ensures you can claim any allowable deductions and avoid unpleasant surprises at tax time.

Remember: Craft pricing isn't just about covering costs, it's about building a sustainable, profitable business.

Types of Craft Business Expenses

Each type of craft business is unique and will have a different set of expenses as well as different product pricing strategies.

The list of expenses below is quite comprehensive. Some items will not apply to your business, and you may have additional expenses that are not on the list.

Materials Cost

Materials cost refers to the consumable, physical supplies and components that go directly into creating your handmade products.

These expenses are the materials that are used up or included in the final product and must be factored into your pricing to ensure you cover your production costs and make a profit.

Even if each item seems small or inexpensive, it all adds up, so you should make sure you account for expenses.

Types of Materials to Include

Here are the main categories of materials you may need to track.

Raw Materials

These are the primary components of your product.

Examples Include:

- Beads, thread, wire, or yarn

- Paint, canvas, or paper

- Clay, wood, fabric, or metal sheets

- Fasteners, or glue

Some materials are used across multiple products.

For example: If you buy 50 feet of sterling silver wire, but only use a small amount of wire in each necklace, you'll need to figure out how much wire goes into one necklace and divide the total cost accordingly to find the material cost per item.

Packaging Materials

If your product includes packaging as part of its presentation, that cost should be included in the materials calculation.

Examples Include:

- Gift boxes or jewelry pouches

- Wrapping paper or tissue

- Product tags, labels, ribbon, or stickers

If the packaging is part of the product (e.g., gift-ready presentation), it should be included in the item's material cost. Shipping supplies like mailers or tape belong under selling or shipping expenses, not here.

Custom or Specialty Components

These are extra or unique elements that enhance the product's appearance or function.

Examples Include:

- Engraved charms

- Decorative clasps or closures

- Specialty findings or fasteners

Some materials are used in just one item.

For example, if you use one decorative clasp per bracelet, the cost per item is easy to calculate. You simply use the price of that single clasp as the material cost for each item - no extra tracking or math required!

Examples: Calculating Material Cost Per Item

Simple Product Example:

You make felt flower brooches and use one sheet of felt, one pin back, and a dab of glue for each. If those materials cost you $0.80 total per brooch, that's your material cost per item.

Complex Product Example:

You make necklaces using a 25-foot spool of silver wire ($30) and premium beads ($20 for 100). If one necklace uses 2.5 feet of wire and 10 beads:

- Wire cost: $30 ÷ 10 = $3.00

- Bead cost: $20 ÷ 10 = $2.00

- Total material cost per necklace = $5.00

Breaking down your materials in this way ensures you're not just guessing. You're using cost-based pricing with precision.

Labor Costs

Labor costs account for the amount of time spent making each item.

Your time has value. It should be factored into your pricing just like materials.

How to Calculate Labor Cost Per Item

To determine labor cost:

- Choose an hourly rate that reflects your skill and experience (at least minimum wage, ideally more).

- Track the time it takes to make one product.

- Multiply the time by your rate.

Example:

- Your hourly rate: $24/hour

- Time to make one item: 30 minutes (0.5 hours)

- Labor cost per item: $24 × 0.5 = $12.00

Repeat this process for each type of product you sell. If a product takes longer, the labor cost will be higher and your pricing should reflect that.

When you pay yourself fairly, you build a more sustainable and profitable business.

Overhead Expenses

Overhead expenses are the ongoing business costs that aren't tied to a specific product but are essential to running your craft business.

They don't show up directly in your materials or labor, but they do affect your bottom line.

Estimating Overhead in Handmade Product Pricing

It's usually not practical to calculate every overhead cost item individually. That's why most handmade sellers estimate overhead as a percentage of their material and labor costs.

Typically, craft sellers will add 10-15% of the cost of materials plus labor to cover overhead.

If your overhead is high, you may need to use a higher percentage.

This method helps you easily spread overhead costs across all products.

Here are typical overhead categories you should consider:

- Studio or home office costs (rent, space allocation at home)

- Utilities (electricity, water, internet, phone)

- Equipment & tool depreciation (wear and tear, replacements)

- Storage and workspace setup

- Insurance & accounting fees

- Software and subscriptions (photo editing, design tools, bookkeeping)

Review your overhead from time to time. As your business grows, these costs can change.

Example Overhead Cost Calculation:

If your material costs are $5, and your labor cost is $12 (30 minutes at $24 per hour)

- Material plus labor costs = $17

- Calculating overhead at 10% = $17 x .10 = $1.70

- Calculating overhead at 15% = $17 x .15 = $2.55

List of Common Overhead Expenses

To help you work through all of your own business expenses, here's a list of expenses many small business owners incur.

Selling Expenses

- Online Store or Marketplace Fees

- Commissions

- Booth Fees

Marketing Expenses

- Photography Expenses

- Display / Booth Setup

- Website

- Advertising

- Packaging

- Other Marketing Materials

Office / Studio Expenses

- Equipment and Tool Expenses

- Software

- Technology

- Packaging and Shipping Supplies

- Workspace Setup

- Storage Solutions

- Safety Equipment

- Maintenance and Repairs

- Renovation and Upgrades

Professional Fees

- Record Keeping

- Accounting

Business Insurance Expenses

Education and Skill Development

Utilities Expenses

- Gas Expense

- Electricity & Water Expense

- Internet Expense

- Cell Phone Expense

- Landline Expense

- Water Heater Rental

Travel Expenses

- Vehicle / Transportation

- Fuel

- Parking

- Hotel / Lodging

- Food while traveling for business

Banking Expenses

- Payment Processing Fees

- Banking Fees

- Currency Conversion and International Fees

Taxes and Licenses

- Permits

- Business License

- Professional Memberships / Accreditations

How to Use This Information to Price Your Crafts

Now that you understand the key types of expenses - materials, labor, and overhead - you're ready to put that knowledge to work in your craft pricing strategy.

Knowing your true costs allows you to:

- Choose profitable products by comparing expenses and margins across your product line

- Adjust your prices confidently when material costs rise or your overhead changes

- Avoid underpricing pitfalls that eat into profits or lead to burnout

Tracking all of your business expenses ensures that you're not guessing. Instead, you're making smart, data-driven decisions that support a sustainable and profitable business.

Tools: Printable Expense Checklist & Online Pricing Calculators

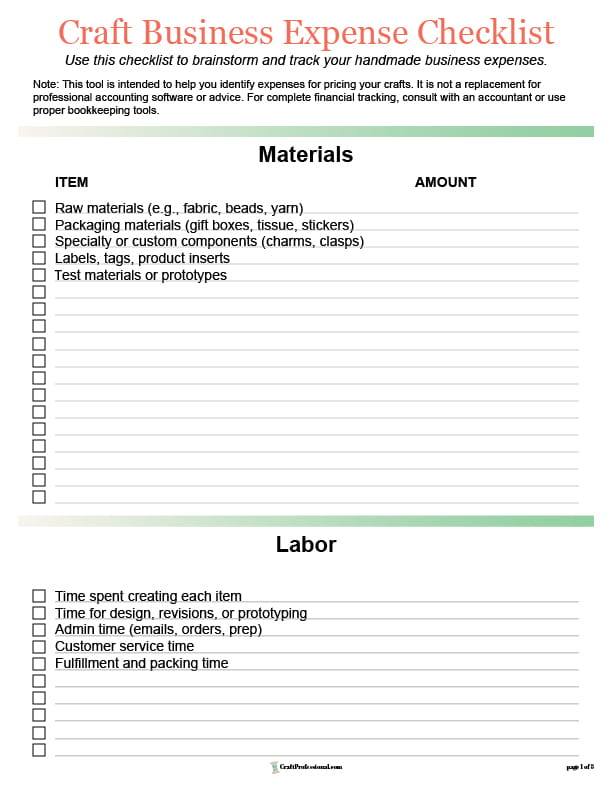

Expense Checklist

If you'd like a worksheet to track your expenses, download our printable Craft Business Expense Checklist to help you think through all of your costs.

Online Pricing Calculators

Once you have a complete list of your expenses, you're ready to calculate your break-even point, as well as possible wholesale and retail prices.

Try our online craft pricing calculators. There are 6 different formulas to make the task of pricing your handmade items easy.

Final Tips & Next Steps

Accurately tracking your expenses is one of the most important steps in building a profitable business. Fortunately, there are simple tools that can help.

Whether you prefer a basic spreadsheet or accounting software, choose a method that makes it easy to track and review your expenses regularly.

Some options for tracking expenses include:

- Google Sheets or Excel

- QuickBooks Self-Employed

- Craft-specific expense trackers or apps

Consistency matters more than complexity. The best system is the one you'll actually use.

Talk to a Professional

While this guide helps you understand which expenses to track for craft pricing, remember, it does not take the place of advice from a professional accountant.

A professional accountant for personalized advice can:

- Help with taxes and deductions

- Ensure you're complying with local regulations

- Set up simple systems to streamline your record-keeping

A little financial planning and professional advice now can save you time, stress, and money down the road.

Frequently Asked Questions (FAQ)

What expenses should I include when pricing my handmade products?

What expenses should I include when pricing my handmade products?

You should include all direct and indirect costs associated with creating and selling your products. This includes:

- Materials (e.g., fabric, beads, packaging)

- Labor (your time spent making each item)

- Overhead (utilities, workspace costs, insurance, software)

- Selling costs (e.g., marketplace fees, advertising)

Tracking all of these ensures your pricing supports a profitable business.

What's the difference between materials cost and overhead expenses?

What's the difference between materials cost and overhead expenses?

Materials cost covers the items used directly in your product (like yarn, clasps, or boxes).

Overhead includes general business expenses that support your work but aren't tied to a single product, like rent, internet, and bookkeeping software.

How do I calculate labor cost per product?

How do I calculate labor cost per product?

First, choose a reasonable hourly rate (e.g., $20/hour). Then, estimate how long it takes to make one item. Next, multiply the time by your rate.

Example: 30 minutes to make a product × $20/hour = $10 labor cost per item

How often should I review my expenses?

How often should I review my expenses?

At a minimum, review your expenses once a year. For growing businesses or sellers with changing product lines, a quarterly review is even better to keep your pricing accurate and responsive to rising costs.

New! Comments

Have your say about what you just read! Leave me a comment in the box below.